By Tom Ayebare

The economics of the Upstream (Tilenga and Kingfisher) and the EACOP projects are distinct and should not be mixed up.

EACOP

The commercial structure for the East African Crude Oil Pipeline (EACOP) as per the Shareholder’s agreement is that the project is jointly funded and owned by the Governments of Uganda and Tanzania, and the licensed oil companies. The agreed shareholding is Total with participation of 62%, CNOOC Limited at 8%, Government of Uganda through the Ugandan National Oil Company (UNOC) with 15%, and Government of Tanzania through the Tanzania Petroleum Development Corporation (TPDC) agreeing to take up to 15%. The agreed Tariff (Transportation charge) of US$12.77 per barrel is payable the EACOP Company (of which Uganda is a shareholder) and, in addition, Uganda as a shareholder through UNOC, will partake of any dividends. Tanzania exempted EACOP from payment of a transit fee.

Upstream,

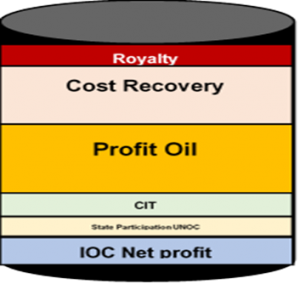

Government revenues from the oil and gas sector include royalties, profit oil share, state participation and taxes. The Production Sharing Agreements (PSAs) signed between Governments and the Oil companies provide for the sharing of petroleum during production. The International Oil Company (IOC) invests capital to explore and develop the resources.

When production of oil starts, Government first receives a royalty payment of between 5% to 12.5% depending on the level of production. Then, the next deduction goes to recovery of the oil company’s costs, which is capped at 70% of the remaining ‘oil’ after royalty deduction. The next payment is considered as profit oil, which is shared between the Company and Government as per the PSAs. Government also receives corporate tax (approx. 30%) on the oil company’s share of profit oil. Government’s total take from the upstream, as per the current PSAs, therefore, ranges from between 65% to 80%, it increases over the years, given that there will be less costs to recover.

The overall projected annual revenues from the sector are estimated at US$1.5bn to US$ 2bn. Besides the revenues, the expected investments of US$15bn over the next four years when construction of the infrastructure will take place, is an immense opportunity for the country through the provision of the required goods and services. In addition, the oil and gas sector will have a positive economic impact on other growth sectors of the economy such as manufacturing, tourism, agriculture, health, among others. It is projected that these linkages will increase Uganda’s revenue/ GDP by US$ 8.4 billion before first oil.

- Royalty based on daily rate of production varies from 5 – 12.5% (incremental sliding scale)

- Cost oil limit – 60 to 70%

- Profit oil which is split based on DROP. GoU share varies from 40 – 67.5% (incremental sliding scale)

- Corporate income tax (CIT) – 30%

- Windfall tax – 15% when international oil price is $75/bbl and above

- State participation – 15% managed by UNOC

- Government take is the summation of Royalty + Government profit oil + CIT + Windfall tax + UNOC net profit

- Government revenues from oil and gas activities also include training fees, surface rentals, bonus, proceeds from sale of Data, WHT, VAT, PAYE and other relevant taxes

The Writer is the Manager, Economic and Financial Analysis at the PAU